What Will Happen if Social Security Runs Out? (Why It’s Possible, How Likely It Is and What You Can Do)

If you’ve begun planning for retirement, the question has probably already crossed your mind: what will happen if Social Security runs out?

While you shouldn’t rely too much on Social Security for your retirement, here’s what you should know about why it could run out, what would happen, how likely it is and how you can respond.

How Does Social Security Work?

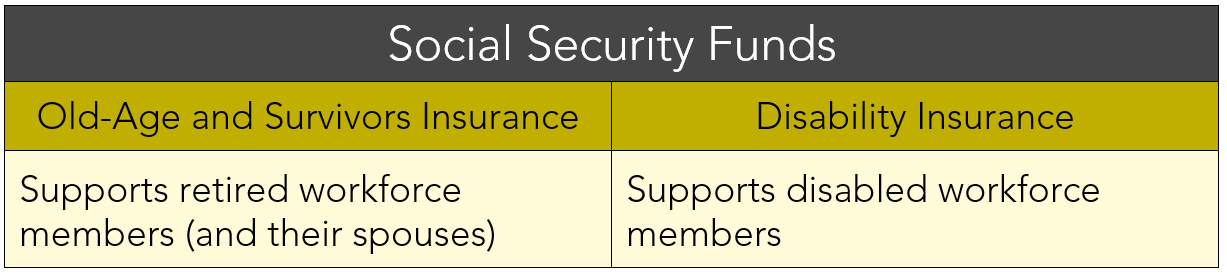

To better understand this dilemma, you first need to know that Social Security consists of two different funds:

- One for Old-Age and Survivors Insurance; and

- One for Disability Insurance.

These funds are set aside and designed to support retired workforce members (and their spouses) or disabled workforce members, respectively.

Social Security taxes are assessed every year up to a maximum level, or cap, which is $142,800 for 2021. That means for workers, Social Security is only taken out of income up to $142,800.

If someone made $152,800, for example, Social Security is only taken out of the $142,800 amount. The extra $10,000 the individual made is not subject to Social Security taxes.

Are Social Security Funds Running Out?

The government released a report in August 2021 telling us the Social Security Trust Fund many Americans rely on for retirement funds will run out of money by 2033, one year earlier than previously projected. The disability fund expects to deplete its funds in 2057, which is eight years earlier than was projected in 2020.

These limitations are reported despite a spike in deaths among retirement-age Americans in 2020 which helped keep costs low.

The Treasury Department reports “the finances of both programs have been significantly affected by the pandemic and recession of 2020,” given the contraction of the workforce during the pandemic and more retirement-eligible people opting to retire early.

To make matters worse, Social Security’s 2022 cost of living increase is anticipated to be the highest in history.

Why is Social Security Running Out of Money?

In its current state, the Social Security Trust Fund pays out more money to retirees than it brings in.

In order to replenish funds, current workers must pay into the fund. Right now, there aren’t enough workers paying enough money to sustain the trust fund.

Given that current birth rates have consistently dropped over the past 10 years (hitting an all-time low in 2020), relying on new workers to continue paying into this fund isn’t a viable option.

The fund will run out of money because it will never be able to pay out more in benefits than it currently takes in from workers. This means Social Security will be unable to send funds out unless it has the money in the fund.

What Will Happen if Social Security Runs Out?

These projections provide insights that our current workforce can continue to support a cash flow rate of roughly 75% of promised benefits. As a result, if Congress doesn’t act before the money runs out in 2033, the current Social Security law cuts benefits to retirees by roughly 20% across the board.

For many Americans who rely so heavily on Social Security to pay rent and buy groceries, a 20% reduction would be catastrophic.

Will That Really Happen?

The good news is that we don’t foresee that happening, given Congress’ transfer of funds from the retirement program in 2016 to the disability program to prevent those funds from running out. Disability recipients did not receive any cuts in benefits.

Further, Congress bailed out underfunded multiemployer pension plans, jointly run by labor unions and private employers across industries by passing an $80 billion-plus payout despite having no legal obligation to do so.

It’s highly unlikely, given Congress’ previous actions, they would allow the Social Security retirement fund to run dry.

Are There Other Options to Prevent Social Security from Running Out?

Yes, there may be other options to increase Social Security trust funds.

First, the income cap could be raised to a higher amount to capture more Social Security taxes. Instead of capping the income at $142,800, the income limit could be raised, which would then provide more Social Security deposits.

Another option may be to continue to raise the age at which individuals become eligible for Social Security, thereby reducing the pool of people who are taking from the trust fund.

Either, or both, may be a good and viable option to assist in preventing the draining of the Social Security trust fund.

What Can Individuals Do?

Regardless of the Social Security trust fund, we are living in crazy, unprecedented times. Now, more than ever, your private retirement accounts are vitally important. So, instead of asking “What will happen if social security runs out?” you may be better off asking yourself, “No matter what happens, am I prepared for retirement?”

Now is the time to take a good look at your 401(k) contributions and really consider whether you are making the most out of your contributions and see if you can do more, save more or plan better.

Connect with an Advisor

If you want to do more for your retirement planning, connect with a Waverly Advisors advisor today to help you plan for your future.

You should not assume that any information provided serves as the receipt of, or as a substitute for, personalized advice from Waverly Advisors. This article reflects information available at the time it was written and should be used as a reference only. Waverly Advisors is neither a law firm nor a certified public accounting firm and no portion of the commentary content should be construed as legal or accounting advice. Talk to your Waverly Advisors, or a professional advisor of your choosing, for the most current information or for guidance specific to your situation.